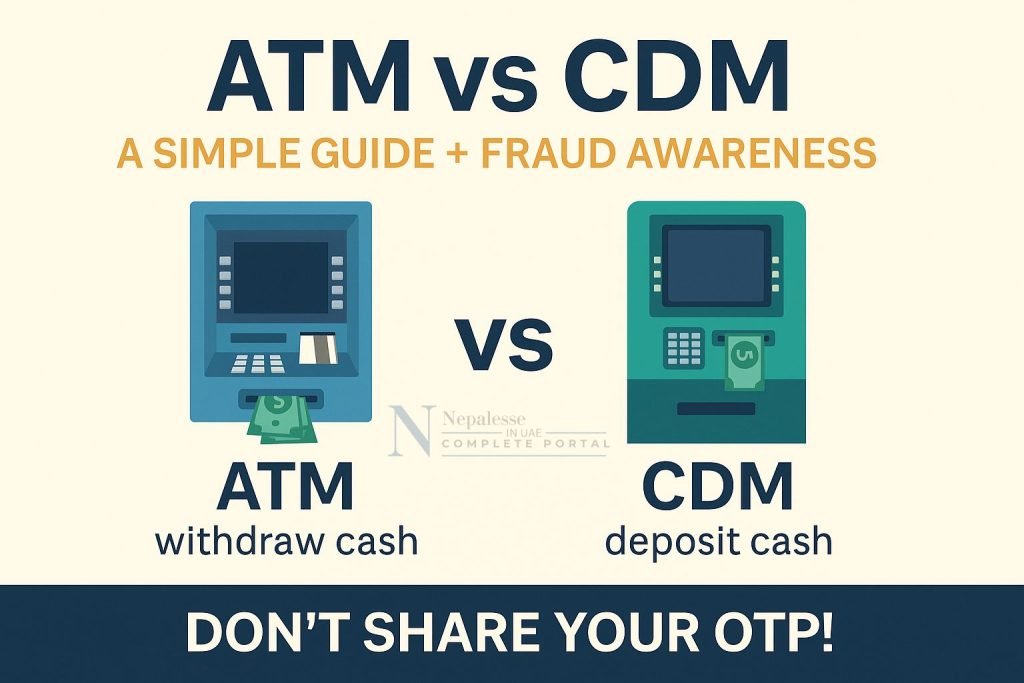

ATM and CDM are two of the most commonly used banking services today.

But many people, especially those new to banking or living abroad, don’t fully understand the difference — or the risks.

This guide is especially useful for Nepalese living in the UAE, who want to manage their finances safely and smartly.

यी दुवै मेसिनले तपाईंलाई बैंक जानु नपरी सेवा दिन्छन्।

तर, सावधान!

आजकल ठगहरूले कार्ड स्किमिङ, फेक OTP माग्ने, क्यामेरा राखेर PIN हेर्ने जस्ता तरिकाले तपाईंको पैसा चोरी गर्न सक्छन्।

OTP कसैलाई नदिनुहोस्।

न बैंक, न पुलिस, न सरकार — कसैले पनि तपाईंको OTP माग्दैन।

सधैं सतर्क रहनुहोस् र यस्ता मेसिन प्रयोग गर्दा सुरक्षित तरिका अपनाउनुहोस्।

What Is an ATM?

ATM stands for Automated Teller Machine.

It is a machine that allows you to withdraw cash from your bank account without going to the bank counter.

- Available 24/7

- Found in malls, metro stations, supermarkets, and outside banks

- You need your ATM card and PIN to use it

ATM = Cash Withdrawal Machine

What Is a CDM?

CDM stands for Cash Deposit Machine.

It is used to deposit cash directly into your bank account.

- Often located near ATMs or inside bank branches

- Useful for individuals or businesses depositing salary, rent, or daily cash

- The amount is credited instantly or within minutes

CDM = Cash Deposit Machine

🔑 ATM vs CDM – What’s the Difference?

| Feature | ATM | CDM |

|---|---|---|

| Purpose | Withdraw cash | Deposit cash |

| Usage | Common for personal use | Often used by business owners |

| Requires | Card & PIN | Card or account number |

| Gives Cash? | Yes | Yes, if the machine has an ATM function as well. |

| Accepts Cash? | No | Yes |

Real-Life ATM Fraud Cases You Must Know

Using an ATM or CDM is generally safe, but there are increasing fraud attempts. Here are 5 real fraud cases that have happened to people — even in the UAE:

1. Card Skimming

Fraudsters fix a hidden device on the card slot to copy your card information.

They may also install a tiny camera to capture your PIN while you type it.

Tip: Always check the ATM before use. Cover the keypad with your hand.

2. Shoulder Surfing

Someone stands nearby and secretly watches your PIN. Later, they may attempt to steal your card and use it.

Tip: Never let anyone stand too close. Use ATMs with privacy panels or inside banks.

3. Fake Helpers

Strangers pretend to be helpful if the ATM “doesn’t work.” They might swap your card or ask you to re-enter details while they watch.

Tip: Never trust strangers around ATMs. If something feels wrong, cancel and walk away.

4. Fake Bank Calls or SMS

Scammers call or message you pretending to be from your bank. They ask for your card number, PIN, or OTP to “verify your account.”

Tip: Banks never ask for PIN or OTP on phone or SMS. Never share it with anyone.

5. Card or Cash Traps

A device inside the ATM blocks your card or cash. Once you leave thinking it’s stuck, the scammer retrieves it.

Tip: If something is stuck, don’t leave. Call your bank or report it to security immediately.

Final Safety Tips for ATM & CDM Users

- ✅ Use ATMs in well-lit, secure areas with CCTV

- ✅ Never share your PIN or OTP

- ✅ Register for SMS alerts to track every transaction

- ✅ Don’t accept help from strangers at the machine

- ✅ If in doubt, cancel the transaction and use another machine

📢 Stay Safe, Stay Informed

Many fraud cases happen simply because people don’t know.

Now that you understand the difference between ATM and CDM — and the risks — you’re one step ahead.

If you found this helpful, share it with your friends and family, especially those new to banking. You may stay in touch with us via our facebook page as well.