March 2, 2025 – The Nepal Stock Exchange (NEPSE) experienced a strong upward trend today, closing at 2,890.28 points, registering an impressive gain of 75.24 points (+2.67%). This marks a continued bullish run, instilling confidence among Nepalese investors both in the country and abroad.

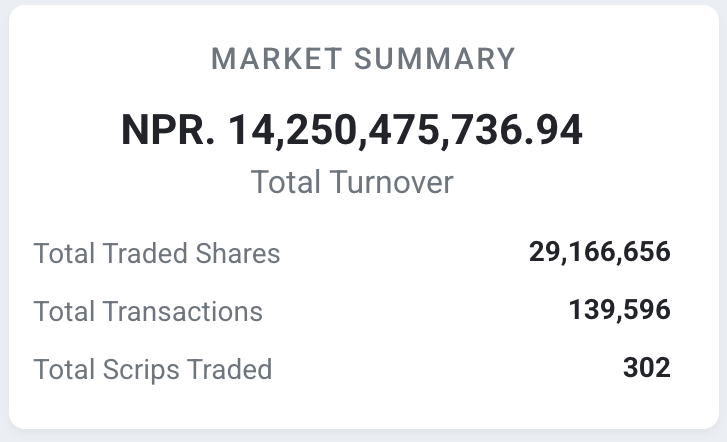

Market Overview & Trading Summary

NEPSE saw a total turnover of NPR 14.25 billion, with 29.16 million shares traded across 139,596 transactions. A total of 302 scripts were exchanged, reflecting heightened trading activity. The bullish sentiment has been evident in the past few trading sessions, signaling strong investor participation, particularly from Nepalese traders living overseas who actively trade in the NEPSE market.

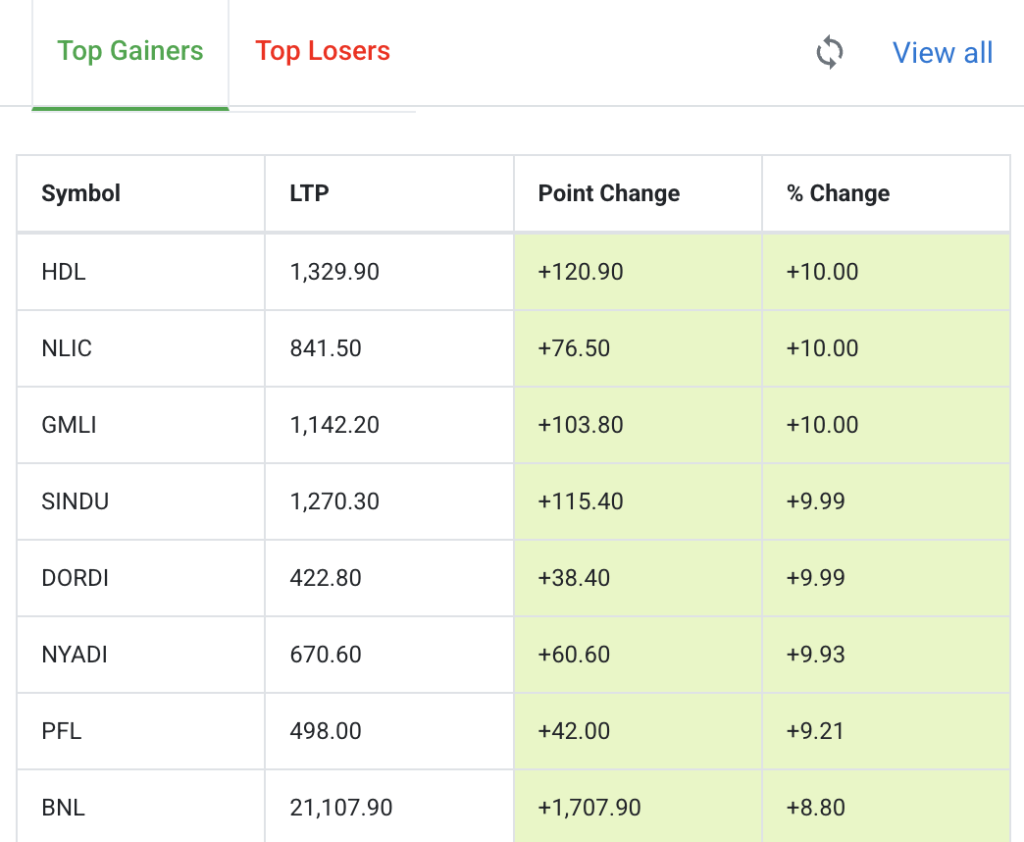

Top Gainers: Strong Performance in Financial & Hydropower Sectors

Several stocks saw a double-digit percentage surge today, with Hydropower and Life Insurance stocks leading the rally. The top gainers of the day were:

- Himalayan Distillery Limited (HDL) closed at NPR 1,329.90, up 10% (+120.90 points).

- Nepal Life Insurance (NLIC) surged 10% to close at NPR 841.50 (+76.50 points).

- Gurans Life Insurance (GMLI) also gained 10%, reaching NPR 1,142.20.

- Sindhu Bikash Bank (SINDU) rose 9.99% to NPR 1,270.30.

- Dordi Khola Hydropower (DORDI) closed 9.99% higher at NPR 422.80.

These gains highlight renewed investor interest in life insurance and hydropower stocks, which have been attracting capital due to their growth potential.

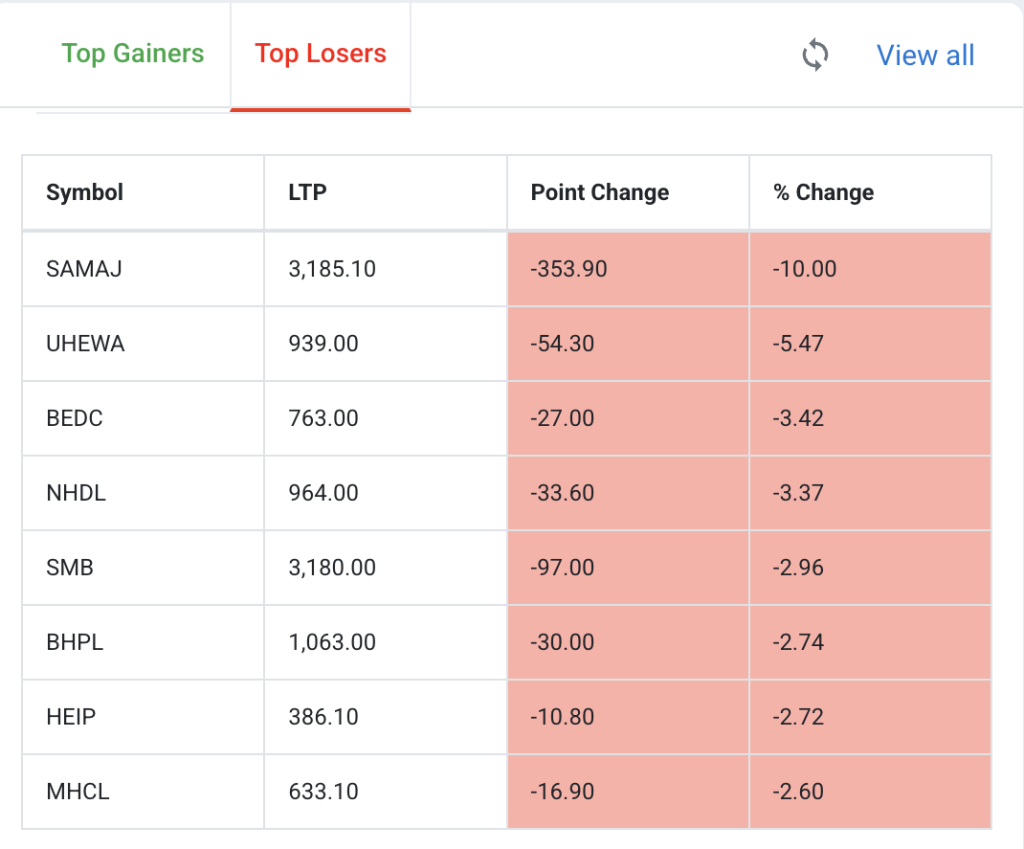

Top Losers: Some Stocks Face Selling Pressure

While the market witnessed an overall bullish trend, some stocks faced downward pressure:

- Samaj Laghubitta (SAMAJ) dropped by 10%, closing at NPR 3,185.10.

- Upper Hewakhola Hydropower (UHEWA) fell by 5.47%, closing at NPR 939.00.

- Bedkot Hydropower (BEDC) declined 3.42% to NPR 763.00.

- Nepal Hydro Developer (NHDL) was down 3.37% at NPR 964.00.

- Sarbottam Cement (SMB) lost 2.96%, closing at NPR 3,180.00.

These declines suggest profit booking in some microfinance and hydropower stocks, possibly due to short-term corrections after previous rallies.

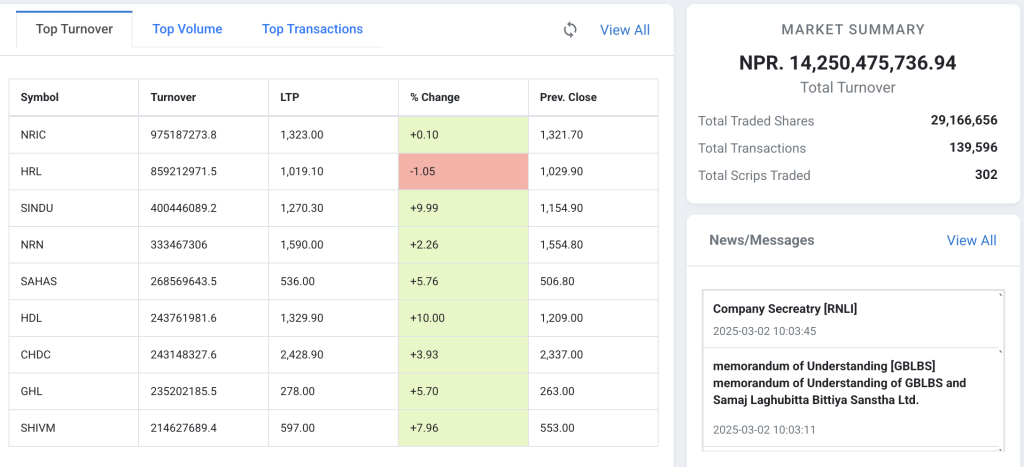

Most Traded Stocks & Top Turnover in NEPSE Market today

The most actively traded stocks by turnover included:

- Nepal Reinsurance Company (NRIC) – Turnover of NPR 975.18 million, closing at NPR 1,323.00.

- Himalayan Reinsurance Limited (HRL) – Turnover of NPR 859.21 million, but declining 1.05% to NPR 1,019.10.

- Sindhu Bikash Bank (SINDU) – Turnover of NPR 400.44 million, rising 9.99%.

- NRN Infrastructure (NRN) – Turnover of NPR 333.46 million, climbing 2.26%.

- Sahas Urja Limited (SAHAS) – Turnover of NPR 268.56 million, gaining 5.76%.

The strong turnover suggests increased institutional and foreign-based Nepali investor participation, particularly in financial, reinsurance, and hydropower stocks.

Technical Analysis: NEPSE Market Index Showing Strong Uptrend

The daily NEPSE candlestick chart indicates a continued uptrend, with today’s closing price nearing the key psychological level of 2,900 points. The increased trading volume (14.25 billion) suggests a bullish breakout, potentially signaling further gains in the coming days. If the index sustains above 2,850, we might see a rally toward the 3,000-mark in the near future.

Outlook for Nepalese Investors Abroad

For Nepalese traders living overseas, today’s bullish momentum presents potential opportunities for short-term and long-term gains. Hydropower, life insurance, and financial stocks continue to be the preferred sectors among investors. However, profit-taking in high-flying stocks could lead to some volatility. Investors should monitor the global economic outlook, remittance trends, and government policies, as these factors significantly impact market movements.

Conclusion

The Nepalese stock market remains on an upward trajectory, with strong performances from hydropower and insurance companies. Investors, especially those trading from abroad, should remain vigilant, considering both the opportunities and risks presented in the current market environment. If the NEPSE index breaks above 2,900, we could see further upward movement, making this an exciting time for traders.

Stay tuned for more market insights, and happy investing!