If you’re looking to start investing in the Nepalese Stock Market, one of the key tools you need is a Mero Share account. It allows you to manage your investments, apply for IPOs, track your securities, and perform transactions easily. In this guide, we’ll cover everything you need to know about Mero Share, why you need it, and how to open one.

What is a Mero Share Account?

Mero Share is an online platform provided by the Central Depository System and Clearing Limited (CDSC) that allows investors to manage their Demat accounts digitally. It acts as an interface to access and monitor your holdings, apply for initial public offerings (IPOs), rights issues, and get detailed reports of your transactions. Essentially, Mero Share makes it easy for investors in Nepal to stay updated on their portfolios and conduct transactions online without visiting a broker.

Why Do You Need a Mero Share Account?

Having a Mero Share is essential if you want to:

- Apply for IPOs and Rights Issues: Mero Share allows you to apply for IPOs and other offerings directly online.

- Access Your Portfolio Digitally: You can easily track your investments, check your balance, and review your holdings.

- Transaction Convenience: You can buy, sell, or transfer securities without dealing with physical paperwork.

Simply put, a Mero Share account is a must-have for investors who want a seamless, paperless, and easy way to manage their investments in Nepal.

Step-by-Step Guide to Open a Mero Share

1. Open a Demat Account

Before opening a Mero Share account, you first need to have a Demat (Dematerialized) account. A Demat account holds your securities in electronic form, and it is crucial for managing your shares and applying for new issues.

To open a Demat account:

- Visit a Depository Participant (DP) such as a bank or financial institution authorized to provide Demat services.

- Fill in the necessary application forms and submit documents like your citizenship certificate, passport-sized photographs, and bank account details.

- After your documents are verified, your Demat account will be opened, and you will receive a BOID (Beneficial Owner Identification Number).

2. Visit Your Depository Participant (DP) for Mero Share Application

Once you have your Demat account, you can apply for Mero Share. The Mero Share account must be linked to your Demat account, which makes it important to apply at the same bank or DP where you opened your Demat account.

- Visit your DP’s branch office.

- Request the Mero Share application form and fill in all the required details.

- Submit a copy of your citizenship certificate and your BOID.

3. Pay the Fees

There is a nominal fee associated with opening a Mero Share. Typically, the annual fee for Mero Share services ranges from NPR 50 to NPR 100, depending on the financial institution. You’ll need to pay this fee during your application.

4. Receive Your Login Credentials

After you submit your application, the DP will process it, which usually takes a few days. Once it’s complete, you will receive login credentials for your Mero Share account. These credentials typically include a username and a password that will be sent to your email address or given to you in hard copy.

5. Log in to Mero Share

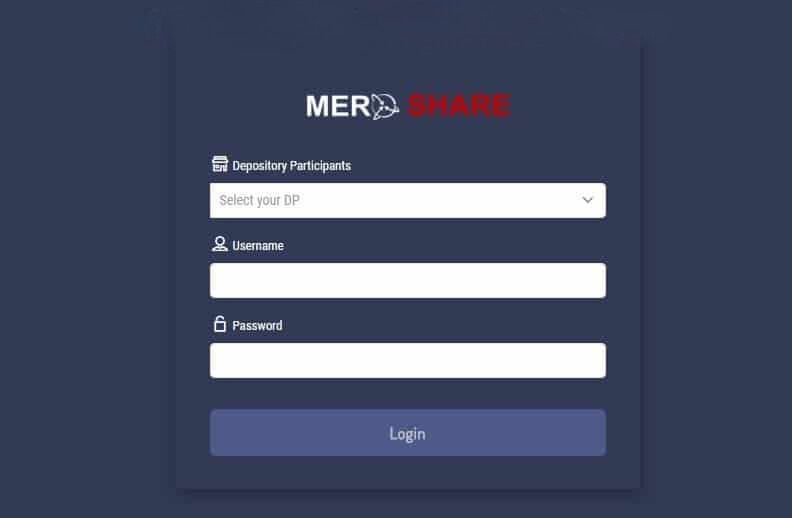

To access your Mero Share account, follow these steps:

- Visit the Mero Share website (https://meroshare.cdsc.com.np/).

- Enter your login credentials.

- Change your password upon your first login to ensure the security of your account.

You are now ready to access your portfolio, apply for IPOs, and track your investments through Mero Share.

How to Use Mero Share

Once your Mero Share account is active, you can start managing your investments. Some of the key features include:

- Apply for IPOs: One of the main uses of Mero Share is to apply for IPOs. Under the “My ASBA” section, you can apply for various IPOs, FPOs, or rights shares.

- Check Your Portfolio: The “My Portfolio” section allows you to check the number of shares you own, including their current value.

- Transaction Details: You can view the history of transactions in your account, including purchase, sales, or bonuses.

Important Tips for Mero Share Users

- Keep Your Login Credentials Secure: Make sure to change your password periodically and do not share your credentials with anyone.

- Stay Updated: Keep track of upcoming IPOs and corporate announcements to make the most of your investments.

- Link Your Bank Account: Ensure your bank account is correctly linked to your Mero Share account to receive dividends and for smooth financial transactions.

Conclusion

Opening a Mero Share account is an important step towards modern, efficient investing in the Nepalese stock market. It provides a convenient way to manage your investments, apply for IPOs, and track your portfolio all in one place. By following the steps outlined above, you can easily set up your Mero Share account and take control of your financial future.

With a Mero Share account, investing in NEPSE becomes simple, paperless, and accessible from anywhere, empowering you to make informed financial decisions with ease.

Mero share account unblock required